Supposedly to ‘punish’ Russia for the successes of the resistance in Ukraine to the US-backed fascist coup, the ‘international community’, i.e., the

imperialist powers of the world, have declared economic war against it, endeavouring to cause such damage to its economy, and suffering to its population,

that it will give up all and any resistance to imperialist demands. Hitherto the US has deployed this tactic with impunity – if without much in the way of

success – against countries without the power to retaliate. Russia, however, is a very different kettle of fish.

Damage to Russian economy

The combination of sanctions, imposed since July 2014, and a plummeting oil price that is the consequence of Saudi Arabia’s decision not to cut oil

production in line with the fall in world demand for oil, has certainly wreaked havoc on the Russian economy:

“

Reviewing the impact of lower oil prices/sanctions/geopolitical risk already on Russia, we can observe:

-

A significant market impact – the rouble has lost more than 34 per cent of its value on a basket basis already this year, Russia’s external

borrowing costs have risen (its 5Y CDS

[5-year credit default swaps]

is wider by 150bps since June), with local interbank borrowing rates close to doubling over the past six months to 13 per cent a year – increasing

the cost for local borrowers. Russian equity indices have lost around a third of their dollar value this year, but this comes after three or four

years of under-performance. Russian borrowers are largely closed out of international capital markets, which is accentuating the dollar squeeze at

home, pressure on the rouble and increased borrowing costs.

-

Central bank reserves have declined by around $90bn (close to a fifth) over the course of the year, with capital flight thought to have doubled

over the year to perhaps around $120bn. However, reserves are still at an elevated level of about $420bn – over 12 months of import cover. In

recent weeks the CBR

[Central Bank of Russia] has stepped away from intervention in defence of the rouble, perhaps looking to conserve FX [foreign exchange] reserves to use these for fire-fighting later should systemic problems appear as a result of the weaker currency, e.g. in the banking sector.

-

The impact on economic activity has been difficult to discern, with Q3 2014 real GDP growth slowing to 0.7 per cent from 0.8 per cent in Q2, but

remaining in positive territory. A range of other indicators, from IP

[industrial production]

, to retail sales, to investment in productive capacity all remained weak or contracting, but outright recession has been avoided. Unemployment has

also remained low, at close to 5 per cent, as Russian companies appear to be conserving labour and waiting to see. Perhaps this resilience reflects

the positive impact of the weaker rouble, or perhaps oil and sanctions stalled an imminent recovery – note that government officials had previously

been predicting an acceleration of growth to 1-2 per cent over the next year and that now the consensus is zero to 1 per cent, suggesting a

combined impact of sanctions and lower oil prices of around 1 percentage point of growth.

-

Inflation has accelerated, rising to 8.3 per cent by October, from just below 6 per cent earlier in the year, reflective of exchange rate pass

through that seems to be accelerating.

-

The budget has remained in surplus, posting a surplus of 1.9 per cent of GDP for the period January – October, helped by higher inflation and the

devaluation of the rouble, which inflates the rouble value of dollar oil receipts. The budget for 2015 appears to have been constructed on

optimistic assumptions of oil averaging $95 a barrel, and finance ministry officials have suggested that budget cuts will be required to cover a

potential Rs1tn ($19bn) shortfall. Budget cuts may prove pro-cyclical amid stalling activity and could well tip the economy into recession in 2015.

“The current account and trade accounts have thus far been slow to deteriorate, albeit this might reflect a lagged effect from lower oil prices. For

September though the surplus on the merchandise trade account dropped to $13bn, from $16.1bn a year earlier, as exports dropped by 13.4 per cent,

partially offset by a 10 per cent drop in imports influenced presumably by the weak rouble and weak domestic growth. A rough rule of thumb from

previous bouts of oil price weakness suggests that each $10 drop in the oil price costs Russia $25-30bn in energy sector receipts. This suggests

already a loss of $80-100bn, which could easily wipe out the current account surplus this year. This would further constrain dollar liquidity,

accelerate capital flight and suggest further downside pressure on the rouble and Russian asset prices

.” (Timothy Ash – of Standard Bank, ‘Can Russia ride out cheap oil and the falling rouble”,

Financial Times blog, 1 December 2014).

It can already be seen that although damage is undoubtedly being caused to the Russian economy, all is not doom and gloom. Timothy Ash points out that it

is even possible that the Russian economy will in the long run be strengthened by the attempts to strangle it:

“

In times like these it is tempting to just focus on the negatives. But lower oil prices for Russia might just have something of a silver lining:

“… on-going, oil-inspired rouble weakness may put right years of Dutch disease, in which significant over-appreciation of the currency in effect

squeezed out much of the non-oil economy by making it uncompetitive. To put this into perspective, in real effective terms the rouble doubled in value

between 2000 and mid-2014. The hope is that western sanctions will also give something of a fillip to the domestic, non-oil sector. That said, years of

underinvestment and now a very uncertain business and economic outlook might still stall much needed investment required to bring about a supply

response.”

Or it may just be that Chinese investors step in to fill the vacuum left by western imperialist sharks.

Russia relaliates

The European Union of course followed the lead of the United States, with the two big bullies convinced that they could beat Russia into submission.

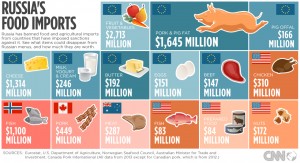

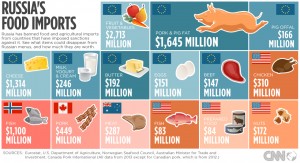

Russia, however, has the strength, the spirit and the leadership to fight back, and to do so in a most intelligent way. It immediately countered by putting

restrictions on the import of European agricultural products – a measure designed to create divisions between the US and the EU and weaken their bullying

solidarity, while considerably strengthening economic ties with China and other countries which are ignoring the imperialist-imposed sanctions regime.

RT

on 9 August 2014 set out the damage that sanctions would do more broadly to the European economy, while noting at that time that the US would hardly be

affected at all:

”

Germany and Poland will lose the most trade with Russia, and neighbouring Finland and Baltic states Lithuania and Latvia will lose a bigger proportion

of their GDP. Norway will see fish sales to Russia disappear, and US damage would be very limited.

“

Russia has banned imports of fruit, vegetables, meat, fish and dairy products from the 28 countries of the EU, the US, Canada, Norway, and Australia for one year.

“

EU trade is heavily dependent on Russian food imports. Last year Russia bought $16 billion worth of food from the bloc, or about 10 percent of total exports, according to Eurostat.

“In terms of losses, Germany, Poland and the Netherlands- the top three EU food suppliers to Russia in 2013 – will be hit hardest. Food for Russia

makes up around 3.3 percent of total German exports.

“French Agriculture Minister Stephane Le Foll said his government is already working together with Germany and Poland to reach a coordinated policy on

the new Russian sanction regime.

”

Last year, Ireland exported €4.5 million worth of cheese to Russia, and not being able to do so this year is a big worry, Simon Coveney, the

country’s agriculture minister, said.

“Farmers across Europe could face big losses if they aren’t able to find alternative markets for their goods, especially fruit and vegetables.

“Some are already demanding their governments provide compensation for lost revenue.

“‘If there isn’t a sufficient market, prices will go down, and we don’t know if we can cover the costs of production, because it is so expensive,’

Jose Emilio Bofi, an orange farmer in Spain, told RT

.

”

The largest opposition party in Greece is urging its government drop sanctions against Russia, even if the move isn’t supported by other EU states.

“In 2013, Denmark supplied Russia with $628 million worth of products which are now banned.

“European Agriculture commissioners will set up a task force to address Russia’s sanctions, on Monday.

“

Border States

“Lithuania and Finland, which both share a border with Russia, could be hit hard by the new restrictions.

“Now a member of the EU and NATO, Lithuania is still closely linked economically with Russia. Banned exports account for 2.5 percent of the country’s

GDP, according to an estimate by Capital Economics.

“Vegetable and foodstuffs are among Lithuania’s top five exports.

“Finland’s dairy industry stands to lose up to $535 million (€400 million) in the trade spat. The country depends on Russia for 14 percent of its

trade.

“Both Finland and Lithuania have already contacted Brussels with complaints.

“Scandinavian neighbour Norway, a large exporter of fish and seafood to Russia, will lose out to domestic fish companies, which have seen their share

prices

soar

after the introduction of the trade restrictions.”

Europe can hardly afford such losses as it is struggling to stay afloat economically, while returning the most dismal growth figures:

”

The ECB staff now expects growth of 0.8 per cent this year, 1 per cent in 2015 and 1.5 per cent in 2016. Only three months ago, the central bank

predicted the currency bloc would expand 0.9 per cent in 2014, and 1.6 per cent and 1.9 per cent, respectively, in the next two years.”

(Claire Jones, ‘Draghi looks to QE despite governing council split’,

Financial Times, 5 December 2014).

“The governments of Hungary, Slovakia and Cyprus have voiced concerns that the sanctions could have a significant negative impact on their domestic

economies.

“In Germany, Europe’s biggest economy, exports to Russia were 26% lower in August than a year earlier, and down 17% year-over-year in the January to

August period, the Federal Statistical Office said Wednesday.

“Russia is still a relatively small market for Germany, accounting for just 3.3% of its total exports of goods and services last year. However, the

Ukraine crisis has hurt overall business sentiment, aggravating an existing slowdown.

“The commission said Russian countermeasures against the EU, including banning many food imports, had placed ‘serious pressure’ on the region’s

farmers, the document showed

.” (Laurence Norman, ‘EU projects impact of sanctions on Russian economy’,

Wall Street Journal, 30 October 2014).

Europe hit by fall in the rouble

The fall in the rouble, however, will do even more than sanctions to damage European exports to Russia:

”

A free falling ruble is essentially shutting out all exports from the EU and the west to Russia. If the currency goes down 2/3, then the price of

western goods triples. Therefore, all EU exports to Russia and those of the rest of the west are stopped in their tracks. Russian agricultural

sanctions are as nothing compared to these new currency sanctions based on the concerted attack on the ruble. As the EU economies are in many areas in

tribulation with 25% unemployment such as Spain, etc. and rising in most cases everywhere, the EU is suffering reciprocal damage for their attack on

the ruble. The western attack on the ruble essentially blocks all imports into Russia forcing them into a German self-sufficiency as in 1933, or Russia

under Stalin in 1937.

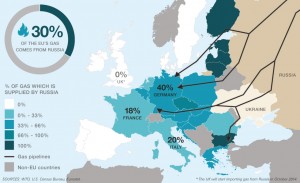

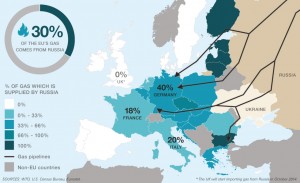

“Russia has not been booted out of the SWIFT payment system as Iran as the international financial system will collapse if Russia unilaterally ceases

to supply energy to Europe in the form of natural gas and oil. If Europe cannot buy Russian natural gas and oil, it will die. It will drag down the

entire international financial system. This time as in Lehman the issuance of trillions of dollars of credits will not save it as that cannot overcome

a shortage of natural resources. The supplies of natural gas and oil from the stans and central Asia between China and Russia are essentially under

Russian control. If they decide to block it, that potentially could remove 24 million barrels a day from the world economy and huge amounts of natural

gas if we add to the central Asian cutoff Russia itself. What will the EU and the United States do? Launch nuclear missiles at Russia?

“If Russia moves to currency controls, the concomitant step would be to declare a moratorium on the payment of interest and principal on external debt.

This in itself would deliver a massive shock to the western financial institutions holding the over $600 billion in debt. It must be remembered when

this happened in 1998 during the Russian financial crisis, the financial weapon of mass destruction of Long Term Capital Management imploded with $1.3

trillion in derivative exposure. The quadrillion of derivatives according to Warren Buffett contain numerous financial weapons of mass destruction that

can implode the entire western financial system. … The west has raised the ante and risked their entire financial system in this crisis.

“It is true that if Russia pulled the plug on the EU by stopping their natural gas and oil exports, it would have an adverse effect on Russia. But it

would have a calamitous effect on the EU. It would trigger implosions in the quadrillion of derivatives. And Russia need only do this for three to six

months to achieve the desired victorious counterattack as in war laying the west low as they are doing to them, and there is no doubt that this is war.

“Economic war precedes military conflict as we saw when the United States, Britain and the Netherlands cut off 92% of the oil used by Japan through an

embargo on July 25, 1941, which was a declaration of war on Japan as the west is declaring war on Russia. Anyone who does not realize this is acting

like an ostrich with his head in the sand. The west is hoping against hope that if they keep raising the ante when they have no cards, that Russia will

throw their cards on the table. This will not happen.”

“Economic war precedes military conflict as we saw when the United States, Britain and the Netherlands cut off 92% of the oil used by Japan through an

embargo on July 25, 1941, which was a declaration of war on Japan as the west is declaring war on Russia. Anyone who does not realize this is acting

like an ostrich with his head in the sand. The west is hoping against hope that if they keep raising the ante when they have no cards, that Russia will

throw their cards on the table. This will not happen.”

(A private email with a subject line of “Russia Under Attack” from David Lifschultz, CEO of Genoil to a small list of prominent CEOs, reproduced in Mish’s

Global Economic website, 23 December 2014)

.

For the first time, then, the imperialist powers are finding out that they cannot fight an economic war without themselves suffering severe casualties.

Sanctions deprive US and European companies of much needed business

Barco is a Belgian company which manufactures digital screens. Sanctions have meant it cannot sell its screens to Russia’s biggest shipbuilder, the United

Shipbuilding Corporation, blacklisted by the EU last July. EU exports generally to Russia have already fallen over 19% since July, with exports of

machinery and transport equipment down over 20%. Italy has been specially badly hit as its manufactured exports as a whole have fallen by half.

Furthermore, Ilya Naymushin of Reuters reported on 22 December, (‘Slumping Russian ruble threatens German economy’) that ”

German companies doing business with Russia are suffering from the weak ruble, as one in three companies will have to fire employees or cancel its

projects, the managing director of the Association of German Chambers of Industry and Commerce warned.

“‘The crisis of the Russian economy leaves behind an even deeper brake track in Russia-based ventures of German businessmen,’ Volker Treier said in an

interview with Bild am Sonntag newspaper.

“The managing director of International Economic Affairs at the Association of German Chambers of Industry and Commerce (DIHK) revealed that “one in

eight companies is considering withdrawing from Russia. So the breach in so many business relations is imminent.”

“According to Treier, the weak Russian currency is hurting German businesses. Ten percent of German companies have said that their long-term Russian

partners are turning away from Europe toward Asian markets.

“‘Thirty-six percent of companies assume that they have to cancel their projects,’ he cited the results of the poll, recently carried out by the German

Chamber of Commerce in Russia among almost 300 German companies.

“This data was backed up by Eckhard Cordes, chairman of Germany’s Committee on Eastern European Economic Relations. ‘At the moment, I expect a 20

percent fall of German exports to Russia by the end of 2014,’ he told Handelsblatt newspaper Friday.

“Cordes added that things are unlikely to improve next year. ‘I generally cautioned against Schadenfreude,’ he said, referring to the notion of taking

pleasure at someone else’s misfortune

.”

Although this will cause thousands of job losses in the EU, this is apparently quite all right because the losses in Russia will be greater still!

Ukraine also dragged down

Even the fascistic puppet regime in Ukraine, on whose behalf imperialism supposedly embarked on its sanctions regime, is broke and is likely to default on

its debts. Its economy is forecast to contract by 7%, a fall to which loss of trade with Russia obviously strongly contributes, so that to keep afloat the

country will need $15bn to be added to the $17bn in international aid that it has already been promised. Apparently, according to Pierre Moscovici, the

policy commissioner for the European Commission, a “

Russian contribution to the package” will be needed if the Ukraine is to avoid default!

Apparently, ”

Wolfgang Schäuble, the German finance minister, said he had called his Russian counterpart, Anton Siluanov, to ask him to roll over a $3bn loan

the Kremlin made to Kiev last year

Wolfgang Schäuble, the German finance minister, said he had called his Russian counterpart, Anton Siluanov, to ask him to roll over a $3bn loan

the Kremlin made to Kiev last year

” (Peter Spiegel and Roman Olearchyk, ‘IMF warns Ukraine bailout at risk of collapse’,

Financial Times, 10 December 2014) In other words, Ukraine

needs money from Russia to support a virulently aggressive anti-Russian government!

International fall-out from plummeting oil price

Although sanctions against Russia left the US relatively unscathed, the same cannot be said of the fall in the oil price. According to the

New York Times of 27 December thousands of workers have been laid off in the United States:

”

States dependent on oil and gas revenue are bracing for layoffs, slashing agency budgets and growing increasingly anxious about the ripple effect that

falling oil prices may have on their local economies.

”

The concerns are cutting across traditional oil states like Texas, Louisiana, Oklahoma and Alaska as well as those like North Dakota that are

benefiting from the nation’s latest energy boom. …

In

“… Houston, which proudly bills itself as the energy capital of the world, Hercules Offshore announced it would lay off about 300 employees who

work on the company’s rigs in the Gulf of Mexico at the end of the month. Texas already lost 2,300 oil and gas jobs in October and November, according

to preliminary data released last week by the federal Bureau of Labor Statistics

.

”

On the same day, Fitch Ratings warned that home prices in Texas ‘may be unsustainable’ as the price of oil continues to plummet. The American benchmark

for crude oil, known as West Texas Intermediate, was $54.73 per barrel on Friday, having fallen from more than $100 a barrel in June.

”

In Louisiana, the drop in oil prices had a hand in increasing the state’s projected 201516 budget shortfall to $1.4 billion and prompting cuts

that eliminated 162 vacant positions in state government, reduced contracts across the state and froze expenses for items like travel and supplies at

all state agencies. Another round of reductions is expected as soon as January.

“And in Alaska – where about 90 percent of state government is funded by oil, allowing residents to pay no state sales or income taxes – the drop in

oil prices has worsened the budget deficit and could force a 50 percent cut in capital spending for bridges and roads

” (Manny Fernandez and Jeremy Alford, ‘Some states see budgets at risk as oil price falls’).

And the trouble doesn’t end there! Low oil prices mean losses for US fracking

companies, which in turn means extensive corporate bankruptcies and failure to repay loans, thereby threatening the lenders, be they the banks or the

purchasers of ‘junk bonds’, i.e., the high risk bonds that have financed much of the US’s fracking frenzy. Oil is not just a commodity, it is also an

asset. If its price suddenly halves, as is happening now, then financial chaos is the inevitable result – as was the case when the US housing market

collapsed in 2007-8. It may be that the oil price has now, at some $60 a barrel as we go to press, fallen further than was foreseen since when it goes

below $70-$80 a barrel US shale production becomes uneconomic. The consequences could be disastrous:

An article by Global Research points out that the low interest rates set by the Fed and its programme of quantitative easing has led to massive corporate

borrowing which has

“made it easier for fly-by-night energy companies to borrow tons of money at historic low rates even though their business model might have been pretty

shaky. Now that oil is cratering, investors are getting skittish which has pushed up rates making it harder for companies to refinance their debtload.

That means a number of these companies going to go bust, which will create losses for the investors and pension funds that bought their debt in the

form of financially-engineered products. The question is, is there enough of this financially-engineered gunk piled up on bank balance sheets to start

the dominoes tumbling through the system like they did in 2008?

” (Mike Whitney, ‘Will falling oil prices crash the markets?’, 12 December 2014).

Russian production costs, on the other hand, are very low – $4 a barrel – and it may even turn out that Russia is better positioned to weather the storm

than its US tormentor. The countries that will be worst affected are those which rely on oil revenues to sustain their social programmes, such as Venezuela

and Iran, which require oil prices of $150 and $140 a barrel respectively in order to balance their budgets. However, even Saudi Arabia, the villain of the

piece, relies on a certain level of oil revenues to provide the salaries that keep its population quiescent, and is now finding that it faces an income

shortfall of $39bn in 2015. Although it does have $900 billion in reserves to tide it over the hard times, it still proposes to cut salaries, wages and

allowances to save money – a move which is far more likely to lead to regime change in Saudi Arabia than the imperialist machinations against Russia are to

lead to regime change there.

As Chairman Mao famously said, the imperialists lift a rock only to drop it on their own feet!

Supposedly to ‘punish’ Russia for the successes of the resistance in Ukraine to the US-backed fascist coup, the ‘international community’, i.e., the

imperialist powers of the world, have declared economic war against it, endeavouring to cause such damage to its economy, and suffering to its population,

that it will give up all and any resistance to imperialist demands. Hitherto the US has deployed this tactic with impunity – if without much in the way of

success – against countries without the power to retaliate. Russia, however, is a very different kettle of fish.

Damage to Russian economy

The combination of sanctions, imposed since July 2014, and a plummeting oil price that is the consequence of Saudi Arabia’s decision not to cut oil

production in line with the fall in world demand for oil, has certainly wreaked havoc on the Russian economy:

“Reviewing the impact of lower oil prices/sanctions/geopolitical risk already on Russia, we can observe:

Supposedly to ‘punish’ Russia for the successes of the resistance in Ukraine to the US-backed fascist coup, the ‘international community’, i.e., the

imperialist powers of the world, have declared economic war against it, endeavouring to cause such damage to its economy, and suffering to its population,

that it will give up all and any resistance to imperialist demands. Hitherto the US has deployed this tactic with impunity – if without much in the way of

success – against countries without the power to retaliate. Russia, however, is a very different kettle of fish.

Damage to Russian economy

The combination of sanctions, imposed since July 2014, and a plummeting oil price that is the consequence of Saudi Arabia’s decision not to cut oil

production in line with the fall in world demand for oil, has certainly wreaked havoc on the Russian economy:

“Reviewing the impact of lower oil prices/sanctions/geopolitical risk already on Russia, we can observe:

“EU trade is heavily dependent on Russian food imports. Last year Russia bought $16 billion worth of food from the bloc, or about 10 percent of total exports, according to Eurostat.

“In terms of losses, Germany, Poland and the Netherlands- the top three EU food suppliers to Russia in 2013 – will be hit hardest. Food for Russia

makes up around 3.3 percent of total German exports.

“French Agriculture Minister Stephane Le Foll said his government is already working together with Germany and Poland to reach a coordinated policy on

the new Russian sanction regime.

”

Last year, Ireland exported €4.5 million worth of cheese to Russia, and not being able to do so this year is a big worry, Simon Coveney, the

country’s agriculture minister, said.

“Farmers across Europe could face big losses if they aren’t able to find alternative markets for their goods, especially fruit and vegetables.

“Some are already demanding their governments provide compensation for lost revenue.

“‘If there isn’t a sufficient market, prices will go down, and we don’t know if we can cover the costs of production, because it is so expensive,’

Jose Emilio Bofi, an orange farmer in Spain, told RT

.

”

The largest opposition party in Greece is urging its government drop sanctions against Russia, even if the move isn’t supported by other EU states.

“In 2013, Denmark supplied Russia with $628 million worth of products which are now banned.

“European Agriculture commissioners will set up a task force to address Russia’s sanctions, on Monday.

“Border States

“Lithuania and Finland, which both share a border with Russia, could be hit hard by the new restrictions.

“Now a member of the EU and NATO, Lithuania is still closely linked economically with Russia. Banned exports account for 2.5 percent of the country’s

GDP, according to an estimate by Capital Economics.

“Vegetable and foodstuffs are among Lithuania’s top five exports.

“Finland’s dairy industry stands to lose up to $535 million (€400 million) in the trade spat. The country depends on Russia for 14 percent of its

trade.

“Both Finland and Lithuania have already contacted Brussels with complaints.

“Scandinavian neighbour Norway, a large exporter of fish and seafood to Russia, will lose out to domestic fish companies, which have seen their share

prices

soar

after the introduction of the trade restrictions.”

Europe can hardly afford such losses as it is struggling to stay afloat economically, while returning the most dismal growth figures:

”

The ECB staff now expects growth of 0.8 per cent this year, 1 per cent in 2015 and 1.5 per cent in 2016. Only three months ago, the central bank

predicted the currency bloc would expand 0.9 per cent in 2014, and 1.6 per cent and 1.9 per cent, respectively, in the next two years.”

(Claire Jones, ‘Draghi looks to QE despite governing council split’, Financial Times, 5 December 2014).

“The governments of Hungary, Slovakia and Cyprus have voiced concerns that the sanctions could have a significant negative impact on their domestic

economies.

“In Germany, Europe’s biggest economy, exports to Russia were 26% lower in August than a year earlier, and down 17% year-over-year in the January to

August period, the Federal Statistical Office said Wednesday.

“Russia is still a relatively small market for Germany, accounting for just 3.3% of its total exports of goods and services last year. However, the

Ukraine crisis has hurt overall business sentiment, aggravating an existing slowdown.

“The commission said Russian countermeasures against the EU, including banning many food imports, had placed ‘serious pressure’ on the region’s

farmers, the document showed

.” (Laurence Norman, ‘EU projects impact of sanctions on Russian economy’, Wall Street Journal, 30 October 2014).

Europe hit by fall in the rouble

The fall in the rouble, however, will do even more than sanctions to damage European exports to Russia:

”

A free falling ruble is essentially shutting out all exports from the EU and the west to Russia. If the currency goes down 2/3, then the price of

western goods triples. Therefore, all EU exports to Russia and those of the rest of the west are stopped in their tracks. Russian agricultural

sanctions are as nothing compared to these new currency sanctions based on the concerted attack on the ruble. As the EU economies are in many areas in

tribulation with 25% unemployment such as Spain, etc. and rising in most cases everywhere, the EU is suffering reciprocal damage for their attack on

the ruble. The western attack on the ruble essentially blocks all imports into Russia forcing them into a German self-sufficiency as in 1933, or Russia

under Stalin in 1937.

“Russia has not been booted out of the SWIFT payment system as Iran as the international financial system will collapse if Russia unilaterally ceases

to supply energy to Europe in the form of natural gas and oil. If Europe cannot buy Russian natural gas and oil, it will die. It will drag down the

entire international financial system. This time as in Lehman the issuance of trillions of dollars of credits will not save it as that cannot overcome

a shortage of natural resources. The supplies of natural gas and oil from the stans and central Asia between China and Russia are essentially under

Russian control. If they decide to block it, that potentially could remove 24 million barrels a day from the world economy and huge amounts of natural

gas if we add to the central Asian cutoff Russia itself. What will the EU and the United States do? Launch nuclear missiles at Russia?

“If Russia moves to currency controls, the concomitant step would be to declare a moratorium on the payment of interest and principal on external debt.

This in itself would deliver a massive shock to the western financial institutions holding the over $600 billion in debt. It must be remembered when

this happened in 1998 during the Russian financial crisis, the financial weapon of mass destruction of Long Term Capital Management imploded with $1.3

trillion in derivative exposure. The quadrillion of derivatives according to Warren Buffett contain numerous financial weapons of mass destruction that

can implode the entire western financial system. … The west has raised the ante and risked their entire financial system in this crisis.

“It is true that if Russia pulled the plug on the EU by stopping their natural gas and oil exports, it would have an adverse effect on Russia. But it

would have a calamitous effect on the EU. It would trigger implosions in the quadrillion of derivatives. And Russia need only do this for three to six

months to achieve the desired victorious counterattack as in war laying the west low as they are doing to them, and there is no doubt that this is war.

“EU trade is heavily dependent on Russian food imports. Last year Russia bought $16 billion worth of food from the bloc, or about 10 percent of total exports, according to Eurostat.

“In terms of losses, Germany, Poland and the Netherlands- the top three EU food suppliers to Russia in 2013 – will be hit hardest. Food for Russia

makes up around 3.3 percent of total German exports.

“French Agriculture Minister Stephane Le Foll said his government is already working together with Germany and Poland to reach a coordinated policy on

the new Russian sanction regime.

”

Last year, Ireland exported €4.5 million worth of cheese to Russia, and not being able to do so this year is a big worry, Simon Coveney, the

country’s agriculture minister, said.

“Farmers across Europe could face big losses if they aren’t able to find alternative markets for their goods, especially fruit and vegetables.

“Some are already demanding their governments provide compensation for lost revenue.

“‘If there isn’t a sufficient market, prices will go down, and we don’t know if we can cover the costs of production, because it is so expensive,’

Jose Emilio Bofi, an orange farmer in Spain, told RT

.

”

The largest opposition party in Greece is urging its government drop sanctions against Russia, even if the move isn’t supported by other EU states.

“In 2013, Denmark supplied Russia with $628 million worth of products which are now banned.

“European Agriculture commissioners will set up a task force to address Russia’s sanctions, on Monday.

“Border States

“Lithuania and Finland, which both share a border with Russia, could be hit hard by the new restrictions.

“Now a member of the EU and NATO, Lithuania is still closely linked economically with Russia. Banned exports account for 2.5 percent of the country’s

GDP, according to an estimate by Capital Economics.

“Vegetable and foodstuffs are among Lithuania’s top five exports.

“Finland’s dairy industry stands to lose up to $535 million (€400 million) in the trade spat. The country depends on Russia for 14 percent of its

trade.

“Both Finland and Lithuania have already contacted Brussels with complaints.

“Scandinavian neighbour Norway, a large exporter of fish and seafood to Russia, will lose out to domestic fish companies, which have seen their share

prices

soar

after the introduction of the trade restrictions.”

Europe can hardly afford such losses as it is struggling to stay afloat economically, while returning the most dismal growth figures:

”

The ECB staff now expects growth of 0.8 per cent this year, 1 per cent in 2015 and 1.5 per cent in 2016. Only three months ago, the central bank

predicted the currency bloc would expand 0.9 per cent in 2014, and 1.6 per cent and 1.9 per cent, respectively, in the next two years.”

(Claire Jones, ‘Draghi looks to QE despite governing council split’, Financial Times, 5 December 2014).

“The governments of Hungary, Slovakia and Cyprus have voiced concerns that the sanctions could have a significant negative impact on their domestic

economies.

“In Germany, Europe’s biggest economy, exports to Russia were 26% lower in August than a year earlier, and down 17% year-over-year in the January to

August period, the Federal Statistical Office said Wednesday.

“Russia is still a relatively small market for Germany, accounting for just 3.3% of its total exports of goods and services last year. However, the

Ukraine crisis has hurt overall business sentiment, aggravating an existing slowdown.

“The commission said Russian countermeasures against the EU, including banning many food imports, had placed ‘serious pressure’ on the region’s

farmers, the document showed

.” (Laurence Norman, ‘EU projects impact of sanctions on Russian economy’, Wall Street Journal, 30 October 2014).

Europe hit by fall in the rouble

The fall in the rouble, however, will do even more than sanctions to damage European exports to Russia:

”

A free falling ruble is essentially shutting out all exports from the EU and the west to Russia. If the currency goes down 2/3, then the price of

western goods triples. Therefore, all EU exports to Russia and those of the rest of the west are stopped in their tracks. Russian agricultural

sanctions are as nothing compared to these new currency sanctions based on the concerted attack on the ruble. As the EU economies are in many areas in

tribulation with 25% unemployment such as Spain, etc. and rising in most cases everywhere, the EU is suffering reciprocal damage for their attack on

the ruble. The western attack on the ruble essentially blocks all imports into Russia forcing them into a German self-sufficiency as in 1933, or Russia

under Stalin in 1937.

“Russia has not been booted out of the SWIFT payment system as Iran as the international financial system will collapse if Russia unilaterally ceases

to supply energy to Europe in the form of natural gas and oil. If Europe cannot buy Russian natural gas and oil, it will die. It will drag down the

entire international financial system. This time as in Lehman the issuance of trillions of dollars of credits will not save it as that cannot overcome

a shortage of natural resources. The supplies of natural gas and oil from the stans and central Asia between China and Russia are essentially under

Russian control. If they decide to block it, that potentially could remove 24 million barrels a day from the world economy and huge amounts of natural

gas if we add to the central Asian cutoff Russia itself. What will the EU and the United States do? Launch nuclear missiles at Russia?

“If Russia moves to currency controls, the concomitant step would be to declare a moratorium on the payment of interest and principal on external debt.

This in itself would deliver a massive shock to the western financial institutions holding the over $600 billion in debt. It must be remembered when

this happened in 1998 during the Russian financial crisis, the financial weapon of mass destruction of Long Term Capital Management imploded with $1.3

trillion in derivative exposure. The quadrillion of derivatives according to Warren Buffett contain numerous financial weapons of mass destruction that

can implode the entire western financial system. … The west has raised the ante and risked their entire financial system in this crisis.

“It is true that if Russia pulled the plug on the EU by stopping their natural gas and oil exports, it would have an adverse effect on Russia. But it

would have a calamitous effect on the EU. It would trigger implosions in the quadrillion of derivatives. And Russia need only do this for three to six

months to achieve the desired victorious counterattack as in war laying the west low as they are doing to them, and there is no doubt that this is war.

“Economic war precedes military conflict as we saw when the United States, Britain and the Netherlands cut off 92% of the oil used by Japan through an

embargo on July 25, 1941, which was a declaration of war on Japan as the west is declaring war on Russia. Anyone who does not realize this is acting

like an ostrich with his head in the sand. The west is hoping against hope that if they keep raising the ante when they have no cards, that Russia will

throw their cards on the table. This will not happen.”

(A private email with a subject line of “Russia Under Attack” from David Lifschultz, CEO of Genoil to a small list of prominent CEOs, reproduced in Mish’s

Global Economic website, 23 December 2014).

For the first time, then, the imperialist powers are finding out that they cannot fight an economic war without themselves suffering severe casualties.

Sanctions deprive US and European companies of much needed business

“Economic war precedes military conflict as we saw when the United States, Britain and the Netherlands cut off 92% of the oil used by Japan through an

embargo on July 25, 1941, which was a declaration of war on Japan as the west is declaring war on Russia. Anyone who does not realize this is acting

like an ostrich with his head in the sand. The west is hoping against hope that if they keep raising the ante when they have no cards, that Russia will

throw their cards on the table. This will not happen.”

(A private email with a subject line of “Russia Under Attack” from David Lifschultz, CEO of Genoil to a small list of prominent CEOs, reproduced in Mish’s

Global Economic website, 23 December 2014).

For the first time, then, the imperialist powers are finding out that they cannot fight an economic war without themselves suffering severe casualties.

Sanctions deprive US and European companies of much needed business

Barco is a Belgian company which manufactures digital screens. Sanctions have meant it cannot sell its screens to Russia’s biggest shipbuilder, the United

Shipbuilding Corporation, blacklisted by the EU last July. EU exports generally to Russia have already fallen over 19% since July, with exports of

machinery and transport equipment down over 20%. Italy has been specially badly hit as its manufactured exports as a whole have fallen by half.

Furthermore, Ilya Naymushin of Reuters reported on 22 December, (‘Slumping Russian ruble threatens German economy’) that ”

German companies doing business with Russia are suffering from the weak ruble, as one in three companies will have to fire employees or cancel its

projects, the managing director of the Association of German Chambers of Industry and Commerce warned.

“‘The crisis of the Russian economy leaves behind an even deeper brake track in Russia-based ventures of German businessmen,’ Volker Treier said in an

interview with Bild am Sonntag newspaper.

“The managing director of International Economic Affairs at the Association of German Chambers of Industry and Commerce (DIHK) revealed that “one in

eight companies is considering withdrawing from Russia. So the breach in so many business relations is imminent.”

“According to Treier, the weak Russian currency is hurting German businesses. Ten percent of German companies have said that their long-term Russian

partners are turning away from Europe toward Asian markets.

“‘Thirty-six percent of companies assume that they have to cancel their projects,’ he cited the results of the poll, recently carried out by the German

Chamber of Commerce in Russia among almost 300 German companies.

“This data was backed up by Eckhard Cordes, chairman of Germany’s Committee on Eastern European Economic Relations. ‘At the moment, I expect a 20

percent fall of German exports to Russia by the end of 2014,’ he told Handelsblatt newspaper Friday.

“Cordes added that things are unlikely to improve next year. ‘I generally cautioned against Schadenfreude,’ he said, referring to the notion of taking

pleasure at someone else’s misfortune

.”

Although this will cause thousands of job losses in the EU, this is apparently quite all right because the losses in Russia will be greater still!

Ukraine also dragged down

Even the fascistic puppet regime in Ukraine, on whose behalf imperialism supposedly embarked on its sanctions regime, is broke and is likely to default on

its debts. Its economy is forecast to contract by 7%, a fall to which loss of trade with Russia obviously strongly contributes, so that to keep afloat the

country will need $15bn to be added to the $17bn in international aid that it has already been promised. Apparently, according to Pierre Moscovici, the

policy commissioner for the European Commission, a “Russian contribution to the package” will be needed if the Ukraine is to avoid default!

Apparently, ”

Barco is a Belgian company which manufactures digital screens. Sanctions have meant it cannot sell its screens to Russia’s biggest shipbuilder, the United

Shipbuilding Corporation, blacklisted by the EU last July. EU exports generally to Russia have already fallen over 19% since July, with exports of

machinery and transport equipment down over 20%. Italy has been specially badly hit as its manufactured exports as a whole have fallen by half.

Furthermore, Ilya Naymushin of Reuters reported on 22 December, (‘Slumping Russian ruble threatens German economy’) that ”

German companies doing business with Russia are suffering from the weak ruble, as one in three companies will have to fire employees or cancel its

projects, the managing director of the Association of German Chambers of Industry and Commerce warned.

“‘The crisis of the Russian economy leaves behind an even deeper brake track in Russia-based ventures of German businessmen,’ Volker Treier said in an

interview with Bild am Sonntag newspaper.

“The managing director of International Economic Affairs at the Association of German Chambers of Industry and Commerce (DIHK) revealed that “one in

eight companies is considering withdrawing from Russia. So the breach in so many business relations is imminent.”

“According to Treier, the weak Russian currency is hurting German businesses. Ten percent of German companies have said that their long-term Russian

partners are turning away from Europe toward Asian markets.

“‘Thirty-six percent of companies assume that they have to cancel their projects,’ he cited the results of the poll, recently carried out by the German

Chamber of Commerce in Russia among almost 300 German companies.

“This data was backed up by Eckhard Cordes, chairman of Germany’s Committee on Eastern European Economic Relations. ‘At the moment, I expect a 20

percent fall of German exports to Russia by the end of 2014,’ he told Handelsblatt newspaper Friday.

“Cordes added that things are unlikely to improve next year. ‘I generally cautioned against Schadenfreude,’ he said, referring to the notion of taking

pleasure at someone else’s misfortune

.”

Although this will cause thousands of job losses in the EU, this is apparently quite all right because the losses in Russia will be greater still!

Ukraine also dragged down

Even the fascistic puppet regime in Ukraine, on whose behalf imperialism supposedly embarked on its sanctions regime, is broke and is likely to default on

its debts. Its economy is forecast to contract by 7%, a fall to which loss of trade with Russia obviously strongly contributes, so that to keep afloat the

country will need $15bn to be added to the $17bn in international aid that it has already been promised. Apparently, according to Pierre Moscovici, the

policy commissioner for the European Commission, a “Russian contribution to the package” will be needed if the Ukraine is to avoid default!

Apparently, ”

Wolfgang Schäuble, the German finance minister, said he had called his Russian counterpart, Anton Siluanov, to ask him to roll over a $3bn loan

the Kremlin made to Kiev last year

” (Peter Spiegel and Roman Olearchyk, ‘IMF warns Ukraine bailout at risk of collapse’, Financial Times, 10 December 2014) In other words, Ukraine

needs money from Russia to support a virulently aggressive anti-Russian government!

International fall-out from plummeting oil price

Although sanctions against Russia left the US relatively unscathed, the same cannot be said of the fall in the oil price. According to the New York Times of 27 December thousands of workers have been laid off in the United States:

”

States dependent on oil and gas revenue are bracing for layoffs, slashing agency budgets and growing increasingly anxious about the ripple effect that

falling oil prices may have on their local economies.

”

The concerns are cutting across traditional oil states like Texas, Louisiana, Oklahoma and Alaska as well as those like North Dakota that are

benefiting from the nation’s latest energy boom. …

In

“… Houston, which proudly bills itself as the energy capital of the world, Hercules Offshore announced it would lay off about 300 employees who

work on the company’s rigs in the Gulf of Mexico at the end of the month. Texas already lost 2,300 oil and gas jobs in October and November, according

to preliminary data released last week by the federal Bureau of Labor Statistics

.

”

On the same day, Fitch Ratings warned that home prices in Texas ‘may be unsustainable’ as the price of oil continues to plummet. The American benchmark

for crude oil, known as West Texas Intermediate, was $54.73 per barrel on Friday, having fallen from more than $100 a barrel in June.

”

In Louisiana, the drop in oil prices had a hand in increasing the state’s projected 201516 budget shortfall to $1.4 billion and prompting cuts

that eliminated 162 vacant positions in state government, reduced contracts across the state and froze expenses for items like travel and supplies at

all state agencies. Another round of reductions is expected as soon as January.

“And in Alaska – where about 90 percent of state government is funded by oil, allowing residents to pay no state sales or income taxes – the drop in

oil prices has worsened the budget deficit and could force a 50 percent cut in capital spending for bridges and roads

” (Manny Fernandez and Jeremy Alford, ‘Some states see budgets at risk as oil price falls’).

And the trouble doesn’t end there! Low oil prices mean losses for US fracking

companies, which in turn means extensive corporate bankruptcies and failure to repay loans, thereby threatening the lenders, be they the banks or the

purchasers of ‘junk bonds’, i.e., the high risk bonds that have financed much of the US’s fracking frenzy. Oil is not just a commodity, it is also an

asset. If its price suddenly halves, as is happening now, then financial chaos is the inevitable result – as was the case when the US housing market

collapsed in 2007-8. It may be that the oil price has now, at some $60 a barrel as we go to press, fallen further than was foreseen since when it goes

below $70-$80 a barrel US shale production becomes uneconomic. The consequences could be disastrous:

An article by Global Research points out that the low interest rates set by the Fed and its programme of quantitative easing has led to massive corporate

borrowing which has

“made it easier for fly-by-night energy companies to borrow tons of money at historic low rates even though their business model might have been pretty

shaky. Now that oil is cratering, investors are getting skittish which has pushed up rates making it harder for companies to refinance their debtload.

That means a number of these companies going to go bust, which will create losses for the investors and pension funds that bought their debt in the

form of financially-engineered products. The question is, is there enough of this financially-engineered gunk piled up on bank balance sheets to start

the dominoes tumbling through the system like they did in 2008?

” (Mike Whitney, ‘Will falling oil prices crash the markets?’, 12 December 2014).

Wolfgang Schäuble, the German finance minister, said he had called his Russian counterpart, Anton Siluanov, to ask him to roll over a $3bn loan

the Kremlin made to Kiev last year

” (Peter Spiegel and Roman Olearchyk, ‘IMF warns Ukraine bailout at risk of collapse’, Financial Times, 10 December 2014) In other words, Ukraine

needs money from Russia to support a virulently aggressive anti-Russian government!

International fall-out from plummeting oil price

Although sanctions against Russia left the US relatively unscathed, the same cannot be said of the fall in the oil price. According to the New York Times of 27 December thousands of workers have been laid off in the United States:

”

States dependent on oil and gas revenue are bracing for layoffs, slashing agency budgets and growing increasingly anxious about the ripple effect that

falling oil prices may have on their local economies.

”

The concerns are cutting across traditional oil states like Texas, Louisiana, Oklahoma and Alaska as well as those like North Dakota that are

benefiting from the nation’s latest energy boom. …

In

“… Houston, which proudly bills itself as the energy capital of the world, Hercules Offshore announced it would lay off about 300 employees who

work on the company’s rigs in the Gulf of Mexico at the end of the month. Texas already lost 2,300 oil and gas jobs in October and November, according

to preliminary data released last week by the federal Bureau of Labor Statistics

.

”

On the same day, Fitch Ratings warned that home prices in Texas ‘may be unsustainable’ as the price of oil continues to plummet. The American benchmark

for crude oil, known as West Texas Intermediate, was $54.73 per barrel on Friday, having fallen from more than $100 a barrel in June.

”

In Louisiana, the drop in oil prices had a hand in increasing the state’s projected 201516 budget shortfall to $1.4 billion and prompting cuts

that eliminated 162 vacant positions in state government, reduced contracts across the state and froze expenses for items like travel and supplies at

all state agencies. Another round of reductions is expected as soon as January.

“And in Alaska – where about 90 percent of state government is funded by oil, allowing residents to pay no state sales or income taxes – the drop in

oil prices has worsened the budget deficit and could force a 50 percent cut in capital spending for bridges and roads

” (Manny Fernandez and Jeremy Alford, ‘Some states see budgets at risk as oil price falls’).

And the trouble doesn’t end there! Low oil prices mean losses for US fracking

companies, which in turn means extensive corporate bankruptcies and failure to repay loans, thereby threatening the lenders, be they the banks or the

purchasers of ‘junk bonds’, i.e., the high risk bonds that have financed much of the US’s fracking frenzy. Oil is not just a commodity, it is also an

asset. If its price suddenly halves, as is happening now, then financial chaos is the inevitable result – as was the case when the US housing market

collapsed in 2007-8. It may be that the oil price has now, at some $60 a barrel as we go to press, fallen further than was foreseen since when it goes

below $70-$80 a barrel US shale production becomes uneconomic. The consequences could be disastrous:

An article by Global Research points out that the low interest rates set by the Fed and its programme of quantitative easing has led to massive corporate

borrowing which has

“made it easier for fly-by-night energy companies to borrow tons of money at historic low rates even though their business model might have been pretty

shaky. Now that oil is cratering, investors are getting skittish which has pushed up rates making it harder for companies to refinance their debtload.

That means a number of these companies going to go bust, which will create losses for the investors and pension funds that bought their debt in the

form of financially-engineered products. The question is, is there enough of this financially-engineered gunk piled up on bank balance sheets to start

the dominoes tumbling through the system like they did in 2008?

” (Mike Whitney, ‘Will falling oil prices crash the markets?’, 12 December 2014).

Russian production costs, on the other hand, are very low – $4 a barrel – and it may even turn out that Russia is better positioned to weather the storm

than its US tormentor. The countries that will be worst affected are those which rely on oil revenues to sustain their social programmes, such as Venezuela

and Iran, which require oil prices of $150 and $140 a barrel respectively in order to balance their budgets. However, even Saudi Arabia, the villain of the

piece, relies on a certain level of oil revenues to provide the salaries that keep its population quiescent, and is now finding that it faces an income

shortfall of $39bn in 2015. Although it does have $900 billion in reserves to tide it over the hard times, it still proposes to cut salaries, wages and

allowances to save money – a move which is far more likely to lead to regime change in Saudi Arabia than the imperialist machinations against Russia are to

lead to regime change there.

As Chairman Mao famously said, the imperialists lift a rock only to drop it on their own feet!

Russian production costs, on the other hand, are very low – $4 a barrel – and it may even turn out that Russia is better positioned to weather the storm

than its US tormentor. The countries that will be worst affected are those which rely on oil revenues to sustain their social programmes, such as Venezuela

and Iran, which require oil prices of $150 and $140 a barrel respectively in order to balance their budgets. However, even Saudi Arabia, the villain of the

piece, relies on a certain level of oil revenues to provide the salaries that keep its population quiescent, and is now finding that it faces an income

shortfall of $39bn in 2015. Although it does have $900 billion in reserves to tide it over the hard times, it still proposes to cut salaries, wages and

allowances to save money – a move which is far more likely to lead to regime change in Saudi Arabia than the imperialist machinations against Russia are to

lead to regime change there.

As Chairman Mao famously said, the imperialists lift a rock only to drop it on their own feet!

Comments are closed, but trackbacks and pingbacks are open.