The ‘polycrisis’

The seriousness of the crisis facing the economies of the capitalist world was recently set out by the Financial Times in the following words:

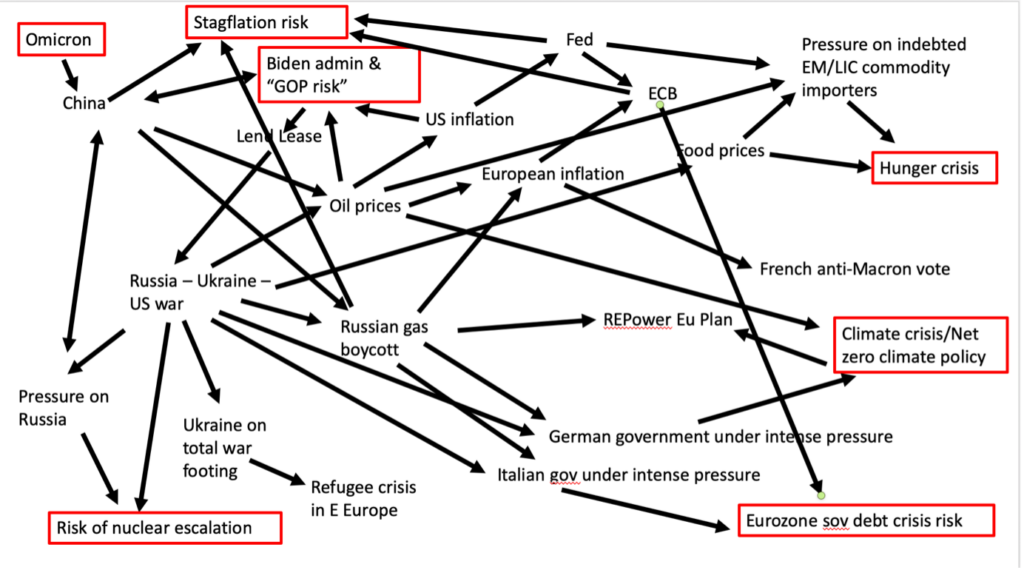

“’Polycrisis’: this was the description Jean-Claude Juncker gave the nexus of challenges facing the EU in 2016, when he was European Commission president. Last week the International Monetary Fund underscored how multiple clouds — including the European energy crisis, rapid interest rate rises and China’s slowdown — have been gathering over the global economy. What has seemed like separate crises emerging from many different regions and markets are now coalescing: we may be facing a polycrisis on a global scale.

“It is rare for so many engines of the global economy to be stalling all at once: countries accounting for one-third of it are poised to contract this year or next, according to the IMF. Indeed, its outlook for the largest economies — the US, the eurozone and China — is bleak. As global inflation rates have touched their highest in 40 years, central banks have been raising interest rates this year with a synchronicity not seen in the past five decades, and the US dollar has hit its strongest level since the early 2000s. These forces are driving the gloomy forecasts and creating new strains.

“Emerging economies have been saddled with higher dollar-denominated debt burdens and disruptive capital outflows. Meanwhile, mortgage rates and corporate borrowing costs have surged across the world. Many gauges of financial market stress are also flashing red, as the rapid snapback in rates from lows during the pandemic has exposed vulnerabilities. Fire-sale dynamics are an ongoing risk, as UK pension funds recently demonstrated” (Editorial, ‘Global economic warninglights are flashing red’, 16 October 2022).

Increasing poverty

Already in 2021 an estimated 698 million people, or 9% of the global population, were living in extreme poverty – less than $1.90 a day. Over 20% of the global population were living below the higher $3.20 poverty line (1,803 million people), and over 40% (3,293 million people) were living below $5.50 a day. According to the UN, between 702 million and 828 million people were already suffering from hunger. Things had improved somewhat since by then the pandemic was on the wane, but now the inflation crisis and the Ukraine war have more than reversed the short-lived improvement:

“Up to [a further] 71 million people from the poorest countries in the world are projected to be facing severe poverty as a result of the war in Ukraine, a report from the United Nations Development Programme published on Thursday [7 July 2022] has found”.

David Pilling from the Financial Times notes:

“Once again, it is the world’s poor who risk becoming collateral damage. As war thunders on in Ukraine, the most deprived people in the Middle East, central Asia and much of Africa will get caught in the crossfire as the price of food escalates and its availability dwindles.

“In 2021, almost 700mn people, or 9 per cent of the world’s population — nearly two-thirds of them in sub-Saharan Africa — lived on below $1.90 a day, the World Bank’s definition of extreme poverty. Any substantial rise in food prices could send millions more tumbling back into this category.

“A report by Standard & Poor’s predicts the food crisis will last through 2024 and possibly beyond. It warns that it could affect social stability, economic growth and sovereign ratings. The International Rescue Committee has alerted the world to an impending ‘hunger fallout’ in which 47mn more people — mostly in the Horn of Africa, the Sahel, Afghanistan and Yemen — could be pushed into acute hunger”. (‘Trouble ahead as the world food crisis starts to bite’, 2 June 2022).

Given that world food production is sufficient to provide every single person on the planet with adequate nutrition, how can it be tolerated that 10% of the world population is starving, war or no war? This is only brought about by humanity stubbornly clinging on to capitalism although it has so manifestly long outlived its usefulness.

Quantitative easing and inflation

In an effort to evade the most unpleasant aspects of the inevitable capitalist crises of overproduction, all the capitalist countries have resorted to debt as a means of keeping up demand for the commodities that have been overproduced. Some of that debt is purely fictitious – money printing by imperialist banks that inevitably devalues money so its overall purchasing power remains unaltered albeit that an illusion has been created that there is more of it. But the borrowing has to be repaid with interest – i.e., from the wealth created by the hard work of the citizens of the countries whose governments have borrowed who must forcibly pay tribute to imperialism, very often leaving themselves short of the necessities of life.

The need for debt to be repaid with interest naturally takes demand out of the economy, exacerbating the crisis of overproduction and triggering more unsustainable borrowing and more inflation.

In the current situation monetary inflation caused by excess money printing is compounded by price inflation caused by a shortage of certain commodities in relation to demand. The latter type of inflation is to a considerable degree caused by Nato’s proxy war in Ukraine against Russia, which has severely reduced world food supplies: “Before Russia’s invasion of Ukraine, the two countries were, either separately or as a pair, among the top three exporters of wheat, maize, rapeseed, sunflower seeds and sunflower oil. Together they accounted for 12 per cent of all traded food calories. Russia is the largest producer of fertiliser. Rising energy costs are affecting everything” (David Pillling, op.cit.).

Increased borrowing costs

Inflation has hit double digits all over the capitalist world.

More inflation leads to lenders demanding higher rates of interest since the value of the capital advanced is being eroded and they need to compensate for this by charging more interest.

The situation in the UK is typical of rich countries: “The annual debt interest bill, which averaged £37 billion from 2010-11 to 2019-20, fell to less than £24 billion in 2020-21. Government debt rose from £1.1 trillion (£1,139 billion) in 2010-11 to £2.1 trillion (£2,134 billion) [nearly £32,000 per head of population] in this period. Everyone would love to borrow this cheaply.

“The era of ultra-low government debt interest is now over. The debt is now almost £2.4 trillion (£2,388 billion) [nearly £36,000 per head of population], and the cost of servicing it is rising. In June alone, the debt interest bill reached a record £19.7 billion [nearly £300 per head of population, or £1,200 for a family of 4], not far short of the annual total for 2020-21” (David Smith, ‘Cheap government debt was a hoot, now brace yourself for the scary bill’, The Times, 23 August 2022).

The inflation rates in many countries such as the Czech Republic (18%), Hungary (20.1%), Poland (17.2%), Turkey (83.45%), Ethiopia (30.7%), Ghana (37.2%), Pakistan (20.3%), Sri Lanka (69.8%), Nigeria (20.8%) and Argentina (83%), to name but a few, are even worse, since lenders also factor in to the interest rates they charge their assessment of the country’s ability to pay, with those that are the poorest to start with having to pay the highest rates of interest.

A vicious circle ensues as, to finance higher interest payments, countries and the people within them need to borrow even more, leading to even greater drops in effective demand for commodities and driving the economic system further and further into recession, i.e., causing GDP actually to fall, always a disaster given that capitalism is driven by an inescapable internal logic that needs it to keep rising in order to stay still.

Debt default and the pension scare

As borrowing and interest rates skyrocket, so does the likelihood of default, which threatens the viability of banks, insurance companies and other financial institutions, which governments are usually forced to pay billions to rescue since their collapse would be disastrous for the millions of people and businesses who have parked their money there in the interval between earning and spending. Banks and insurance companies too need to invest the money that is entrusted to them, typically by lending it out at interest. They of course usually require security, i.e., that the borrower transfer to them his rights to valuable property in the event of him defaulting. In times such as the present, there is not only a huge increase in the number of defaults, but the securities given (such as government bonds, company shares, real estate, etc.) may well have dropped significantly in value because of the crisis and be insufficient to cover the unpaid debts. It is very often that the security given is itself a debt that turns out to be bad, a ‘financial weapon of mass destruction’ which from time is capable of causing a venerable financial institution to crumble into dust, taking its depositors’ wealth along with it.

There has in fact recently been quite a scare about pension schemes run by insurance companies which in the past few years of low interest rates had been investing in LDIs (Liability Driven Investments) that produced relatively high returns so that current pensioners could be paid, but which were of course relatively risky. Because of that the insurance companies have to hold given amounts of cash that at any given time will meet their obligations should any LDI fail to deliver. The general rises in interest rates, which ought to have brought relief to the pension schemes, and to a certain extent have, had a severe downside in that they were causing the value of government bonds (gilts) held by the insurance company to plummet, since their market value fluctuates according to how much has to be invested to produce a given return. Obviously, the higher the interest being paid, the less needs to be invested. The pension funds faced having to sell more and more of their gilts at lower and lower prices in order to provide the necessary collateral for their LDIs, and were in danger of being bankrupted. Therefore, to maintain the price of the gilts despite the increased return, the Bank of England came to the rescue by money printing to purchase these instruments but would not have been able to carry on doing so forever. Hence the departure of Liz Truss whose underfunded minibudget had driven up interest rates payable on the government’s debts, and the installation of Rishi Sunak, the reversal of the Truss policies and, subsequently, a £10 billion a year fall in the cost of borrowing. However, “The bad news is that the LDI drama might just be a portent of trouble to come. It has underlined a few things. … There is a sea of hidden debt lurking beneath the surface of the financial system — a series of buried bombs — and no one is sure where the next one will detonate. In the decades since the Fed arranged that bailout [of LTCM], complacency has, if anything, grown. But — and this is the second thing — we are living in an environment where these explosives are more liable to go off.

“’There’s an enormous amount of debt in the system, and we are in the midst of a hiking cycle on a speed and scale that we haven’t seen for many years,’ says Daniela Russell, head of UK rates strategy at HSBC. ‘There is definitely a view that the recent issue that started with UK LDI is not an isolated incident but the start of a trend’” (Ed Conway, ‘The debt time bomb that blew up Truss’, Sunday Times, 22 October 2022). In short, expect more trouble to come!

Milking it

As governments struggle to pay ever-higher interest payments while at the same time their tax income is typically decreasing because GDP is falling, they resort to austerity – restricting expenditure on providing public services and increasing rates of taxation – in order to try to balance the books so as to avoid being classed as loan risks (which is what happened to the UK when the Liz Truss mini-budget so obviously failed to ‘balance the books’). The austerity falls squarely on the working class, which is already suffering from falling living standards, while typically the rich, the financiers who are collecting in all the high interest tribute, get richer and richer. The emoluments being extracted by CEOs are a notorious example:

“The boss of TotalEnergies, the French oil giant, has caused a storm after taking to social media to justify his €6 million salary in the midst of strikes that have triggered a national fuel shortage.

“Patrick Pouyanné, 59, tweeted: ‘I am tired of the accusation that I gave myself a 52 per cent pay rise.’ He posted his recent remuneration to show that his 2021 pay only increased because he had taken a voluntary 36 per cent cut in 2020.

“His pay, combined with news that TotalEnergies had raked in profits of $10 billion for the first half of 2022, incensed unions and the country’s leftwing opposition, prompting strikes by refinery workers at the company who have been demanding a 10 per cent pay rise” (Charles Bremner, ‘TotalMonEnergies boss defends his €6m salary amid French strikes, The Times, 19 October 2022).

Monsieur Pouyanné is only one of most:

“Bosses of FTSE 100 companies are set to face growing calls for pay restraint amid the cost of living crisis after it emerged that the median package handed to the heads of Britain’s biggest companies jumped to £3.41 million last year” (Emma Powell and Ben Martin, ‘Average pay of FTSE 100 bosses rises to nearly £3.5m’, The Times, 22 August 2022).

The most egregious example is set by Britain’s water companies:

“Amid mounting criticism of the response to the drought by the 15 companies in England, it emerged that dividend payments to parent companies totalled £1.1 billion in the past year, up 18.7 per cent on the previous 12 months.

“An analysis of Companies House records found that chief executives at the companies earned £34.1 million in the past two years, including £22 million in bonuses and incentives.

“Thames Water paid shareholders £37.1 million last year and £1.6 billion over the past 12 years.

“The company, England’s largest, loses 605 million litres a day through leaks, the most of any English firm. Its chief executive, Sarah Bentley, received £3.2 million in the past two years. Bentley, who lives in a £1.5 million five-bedroom home in Surrey and has been pictured holidaying in the French ski resort of Saint-Martin-de-Belleville, received a £496,000 bonus last year, almost double her previous year’s performance-related payout, plus a salary of £750,000….

“Yorkshire Water paid £52.6 million in dividends in the past year. The company leaks 291 million litres a day according to industry figures. Its chief executive, Liz Barber, received a pay package worth over £2.7 million in the past two years…

“United Utilities, which serves northwest England, paid £296 million in dividends in the past year, the most paid by any water company. The company, which has paid almost £3.1 billion in dividends since 2010, the highest amount in that period, leaks 413 million litres of water a day…

“Severn Trent Water, which serves the Midlands, paid about £254.5 million in dividends in the past year. The company, which has paid £2.5 billion in dividends in the past 12 years, leaked the second largest amount of water of any English water company, with a three-year average of 446 million litres a day.

“Liv Garfield, its chief executive, has earned almost £7 million since 2020, making her the highest-paid executive in England’s water industry….” (Ali Mitib, ‘Water companies pay £1bn dividends as the taps run dry’, The Times, 13 August 2022).

In fact, this news caused so much scandal that the regulator Ofwat is currently engaged in forcing shareholders to put substantial amounts of money back into these companies if they want to retain their franchises.

No solution within capitalism

Imperialism seeks to survive by extending its domination over the globe, leading to war – financed by yet more borrowing, again exacerbating the crisis, while redoubling the misery faced by the masses.

And what do we do about it? The financier bandits who collect up all the tribute from the starving people and increase their wealth exponentially while standards of living of ordinary people are plummeting all around them, make sure that the population at large is provided with no end of distractions preventing it from striking the necessary blows in the necessary direction. Religion, navel-gazing identity politics, racism, etc., are all too familiar methods of crowd control. An unremitting dose of anti-communist propaganda completes the picture.

This is the chaos faced by governments in all parts of the capitalist world. As the Financial Times (op.cit.) points out:

“The multiple and mutually reinforcing shocks have left policymakers with a difficult balancing act. For governments, efforts to boost growth and support households and businesses need to avoid pouring further fuel on the inflationary fire and raising debt burdens — which have already been pushed up by the pandemic — particularly as borrowing costs are now rising. The more interest rates rise, the greater the risks of a housing market crash and further financial market strains. Yet for central bankers, not tightening monetary policy enough may embed high inflation.”

Heads of those governments, be they presidents, prime ministers or army generals, are elected or appointed by the billionaire bourgeoisie with the remit of sorting out the mess. But of course they can’t. The problem is that it is the system that is unworkable, and will remain so whether the person in charge of government is competent or a total moron. Therefore the skills required of such a person are the skills of the snake oil merchant, skills in manipulating markets through well-placed rumours or empty promises and making them believed. These are skills that Rishi Sunak has in abundance and which in their day made him a hedge fund billionaire, but which his Yorkshire lass predecessor completely lacked. As Ambrose Evans-Pritchard tactfully put it: “We are heading into months of economic trauma. It is much easier to navigate these dangers under a leader schooled at Goldman Sachs, with a feel for investor psychology and the rhythms of the world market …” (‘Sunak is the providential prime minister for the immediate task at hand”, The Telegraph Economic Intelligence, 25 October 2022).

Sheer madness

It takes the Bank of England Monetary Policy Committee to give the final twist to the lunacy of the capitalist economy:

“The monetary policy committee has acknowledged that the greatest risk to Britain’s economic outlook lies in the tightness of the labour market. … There are 1.3 million unfilled vacancies at present and unemployment is just 3.8 per cent, below the Bank’s own assessment of effective full employment. That has given workers considerable bargaining power. The Bank thinks it will take a sharp rise in unemployment to 6.25 per cent next year to bring inflation back below the target of two per cent”. Yet “According to the Bank, the rise in interest rates before [4 August 2022] had already added £80 a month to the mortgage interest payments of a family with a mortgage balance of £140,000 and a remaining term of 17 years. That would rise to £200 a month if rates rise to three per cent. That is on top of the rise in energy prices, which are expected to hit £3,500 a year for the typical household when the new cap is introduced in October, up from just under £2,000 in April. The result is the steepest decline in living standards on record, with household disposable income forecast to fall by 3.7 per cent over the next two years” (Editorial ‘The Times view on the Bank of England’s warning: Shock Therapy’, 5 August 2022).

What sort of a system is it that it is threatened by low unemployment, even while the purchasing power of wages is falling rapidly? Which posits that it’s not enough to have dirt cheap workers but actually wants fewer of them? Surely there can be no more poignant sign of dysfunctionality of this rotten system!

Of course, capitalist crises have always played themselves out to be followed by a period of relative boom. A government leader who is in position at the right time will invariably be given the credit for his or her economic genius when the economy, of its own accord, picks up again after a period of recessionary devastation. Unfortunately, as things stand at present, this is unlikely to happen until after the world has been plunged into more famine and more war, and the planet has suffered even greater damage than it has up to now. It is quite probable that a devastating third world war stands between us and an economic recovery which, should capitalism survive, cannot be anything but temporary before crisis strikes yet again.

Why then would any Marxist describe this abject economic environment as ‘excellent’?

Our society is old and past its sell-by date. However, it is, in excruciating pain, struggling to give birth to the new. The new proletarian society will implement a planned economy driven not by lust for profit but by the need to meet people’s needs, be they material, cultural or intellectual. The turmoil is showing that the old society is failing in strength, creating greater and greater possibilities for its replacement. That is truly excellent.

Comments are closed, but trackbacks and pingbacks are open.