A pensions crisis is looming for British workers – a crisis brought into sharp focus in the first instance by the collapse of construction firm Carillion. Around 29,000 members of the Carillion pension scheme face an uncertain future, with cuts to their pension likely to follow. The company’s collapse followed the growth of its pension deficit from £318 million in 2015 to £587 million in 2017. To add insult to injury, last year alone, chief executive Richard Howson was paid £1.5 million including a £245,000 bonus. One may wonder what he did to achieve such a bonus after leading a company to collapse and after overseeing a steep rise in the pension deficit!

A pensions crisis is looming for British workers – a crisis brought into sharp focus in the first instance by the collapse of construction firm Carillion. Around 29,000 members of the Carillion pension scheme face an uncertain future, with cuts to their pension likely to follow. The company’s collapse followed the growth of its pension deficit from £318 million in 2015 to £587 million in 2017. To add insult to injury, last year alone, chief executive Richard Howson was paid £1.5 million including a £245,000 bonus. One may wonder what he did to achieve such a bonus after leading a company to collapse and after overseeing a steep rise in the pension deficit!

“There’s an unfortunate journalistic habit (I plead guilty) of describing traditional, defined-benefit pension promises as ‘guaranteed’ or ‘gold-plated’. The Carillion collapse … is an icy reminder that sometimes they are nothing of the sort. Almost 29,000 former and present workers probably won’t get their full promised pensions.

“The 16,000 of them who have not yet retired face an immediate reduction of 10 per cent in their promised pensions. All stand to be disadvantaged in the long run because of the reduced inflation-proofing offered by the Pension Protection Fund.

“The rule of thumb for those whose pension schemes are put into the PPF is that, over a lifetime, the member’s typical haircut is 15 per cent. Not so gold-plated, after all. And there is nothing to stop the PPF further watering down benefits if it were to be hit by a rash of employer failures in future.

“Corporate failures are, of course, relatively rare in any one year. But over the 60 or more years that the saving employee has to think about, they are really quite common. The Pension & Lifetime Savings Association, the trade association for those involved in designing, operating, advising on and investing in pensions, has calculated that there are now three million people in Britain with only a 50-50 chance of getting their full pensions.

“Companies go bust. It happens” (Patrick Hosking, ‘The pension transfer that could dwarf the scandal at Carillion’, The Times, 16 January 2018).

This latest disaster follows the administration of retailer BHS in 2016. In that case 19,000 workers were left to fear for the safety of their pensions. Workers who pay into these schemes hoping to retain a semblance of dignity in old age are having their futures put at risk by big business. Across the board there is a theme of growing pension deficits combined with eye watering executive pay.

“Some of Britain’s biggest companies have handed billions of pounds to shareholders and continued to give executives large pay packets despite soaring pension deficits.

“Bosses at companies with large pension deficits have paid themselves almost £370 million over the past five years despite shortfalls increasing by almost 50 per cent.

“Nigel Stein, who stepped down as chief executive of the engineering company GKN this month, received pay and benefits of £13 million over the past five years. Over that period the company’s deficit doubled to more than £2 billion.

“Gavin Patterson, the chief executive of BT, has enjoyed remuneration packages worth more than £20 million since 2013 despite the company having a growing pension deficit which has now topped more than £9 billion.

“Elsewhere, Ian King, the former chief executive at the defence company BAE Systems received a pay package worth £15 million in the five years before his retirement last June while the company’s pension deficit grew by a third to more than £6 billion.

[Thes]e collectively paid out almost £20 billion in dividends over the past five years while putting only £7.5 billion towards reducing their pension deficits. Over the same period, their total pension deficits have risen from £17.6 billion to £25.8 billion.

“Tesco, which has a pension deficit of almost £3 billion, has paid out £3.2 billion in dividend payments over the past five years while spending only £668 million on reducing its deficit.

“BT has spent £2.7 billion on reducing its £9 billion pension deficit, which represents a third of its market value. In the same period it has handed nearly £5 billion to shareholders. Severn Trent has given shareholders more than £1 billion, twice the size of its deficit” (Billy Kember, ‘Bosses and shareholders handed billions as pension deficits grow’, The Times, 27 January 2018).

Time and again executives and shareholders are being rewarded for failure at the cost of workers who took seemingly responsible measures to safeguard their futures. Money that should be used to reduce, and even wipe out pension deficits is instead being paid directly to executives and shareholders.

“Steve Webb, the former pensions minister who is now head of policy at Royal London, said he was concerned that senior executives’ bonuses were often linked to measures that ‘directly or indirectly will relate to share price and dividends. The way they are paid gives them a leaning towards paying bigger dividends,’ he said. ‘What you want is a neutral decision in the interest of the company and the pension fund.

“’It might be the right answer to pay a decent level of dividend but the risk is they overdo it to the detriment of the pension fund’” (ibid.,).

For her part Theresa May has claimed there will be sanctions for “executives who try to line their own pockets”. But talk is cheap, and it was the Conservatives who helped speed up this inevitable crisis as companies look to exploit the pensions freedoms introduced by George Osborne in 2015.

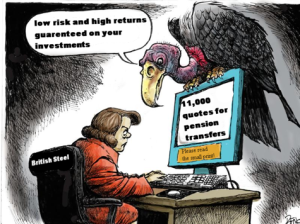

“More than 50,000 British workers may be being cheated out of part of their pension each year, according to a scathing report by MPs who warned of another ‘major mis-selling scandal’.

“The work and pensions select committee accused regulators of ‘fiddling while Rome burns’ after its investigation found that unscrupulous financial advisers, sometimes employing ‘vulture’ intermediaries at factory gates, had persuaded steelworkers to transfer their final salary pension pots.

“In some cases savers were ‘shamelessly bamboozled’ into putting their savings into risky funds with hefty annual adviser fees of 2 per cent and punitive exit penalties of up to 10 per cent.

“The committee warned that this practice could be being carried out across the country as the pension freedoms introduced by George Osborne in 2015 are exploited.

“’Research by the Financial Conduct Authority, which regulates advisers, shows that only half of such advice nationwide meets its standards’, the committee’s report said.

“’Yet over 100,000 people a year are taking defined benefit — final salary— transfers on the back of this advice. Another major mis-selling scandal is already erupting and we therefore call on the relevant bodies to treat this as such and take urgent action,’ it added.

“The FCA’s review, published in October, found fewer than half of transfer recommendations made by advisers to their clients were correct. The FCA is undertaking a further review this year.

“The work and pensions committee’s investigation followed Tata Steel’s decision last year to offload the £15 billion British Steel Pension Scheme (BSPS), giving steelworkers in Port Talbot the choice either to move to a less lucrative plan, stay in their current fund, which would now be managed by the Pension Protection Fund, or exercise pension freedoms and transfer their savings.

“So far 2,600 out of 130,000 savers have chosen to transfer their money since last March, equating to a total of £1.1 billion. The average value of individual transfers is £400,000 and in about 20 cases exceeded £1 million.

“The committee claimed the process of transferring funds had been rife with abuse, with some workers persuaded to move their money after being targeted by hawkers at their workplace gates. One company, Celtic Wealth, held ‘sausage and chips’ lunches for steelworkers at which they were persuaded to sign up for schemes they did not fully understand, it was claimed. Another company named by the committee, Active Wealth, has entered liquidation” (David Byers, ‘Factory gate ‘vultures’ feast on British Steel pensions’, The Times, 15 February 2018).

The aforementioned former Pensions Secretary Steve Webb has claimed there is no ‘silver bullet solution’. Under the profit-driven capitalist system this may be true. But a silver bullet solution does exist, and the silver bullet is socialism. Socialism will not only eradicate excessive bonuses driven by greed, fundamental changes in production will kill the profit motive. Instead of a spontaneous economy driven by profit and personal greed, a rational planned economy will serve all. There will be no speculation, no amassing and stockpiling of wealth. Every single aspect of production will be geared to service of the masses. Like most problems facing the working class today, socialism is the solution.

Comments are closed, but trackbacks and pingbacks are open.